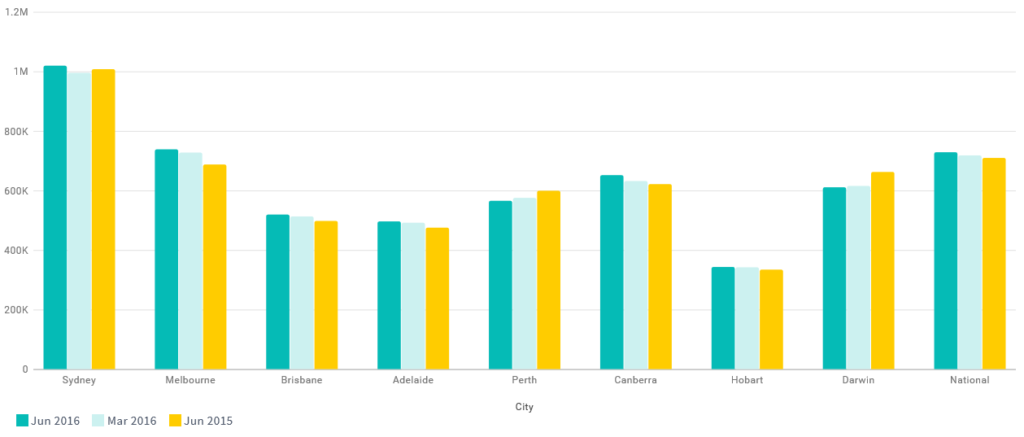

Owning your own home is the dream for most Australians. Domain’s quarterly property report looks at each state and reports on property valuation movements for houses and apartments.

Sydney

Prices dipped the previous quarter, but lower interest rates have bolstered buyer confidences and Aussies are getting back into the market, hunting for homes and investment properties.

Apartments: ⇑ 0.6% to $669,830

Houses ⇑ 2.4% to $1,021,968

Melbourne

Melbourne’s market has the strongest annual growth of any capital city and, this quarter, the median house price has hit a record high of $740 995

Apartments: ⇑ 3.5% to $450,933

Houses ⇑ 1.5% to $740,995

Brisbane

The Brisbane house market has grown steadily in recent years and this quarter is no different, with the median price rising 1.2 per cent to $521,915

Apartments: ⇓ 1.8% to $370,251

Houses ⇑ 1.2% to $521,915

Adelaide

There have been mixed results for Adelaide’s market this quarter, with investors and buyers reviving the house market while unit prices fall.

Apartments: ⇓ 1.7% to $294,165

Houses ⇑ 0.9% to $498,927

Perth

While many capitals are on the rise, Perth’s market has taken another knock as the mining sector slows.

Apartments: ⇓ 2.4% to $367,025

Houses ⇓ 1.7% to $568,132

Darwin

Similar to the market conditions in Perth, decreasing mining activity has caused many temporary workers to leave Darwin, pushing house prices in the capital down.

Apartments: ⇔ 0.0% to $448,417

Houses ⇓ 0.7% to $613,590

Canberra

Canberra is the top market performer this quarter, with investor and seller activity invigorated by lower interest rates.

Apartments: ⇓ 1.6% to $399,505

Houses ⇑ 3.1% to $654,306

Hobart

Hobart is still the most affordable capital in the nation, especially in comparison to property markets in Sydney and Melbourne, but the city is on the rise.

Apartments: ⇑ 2.5% to $276,312

Houses ⇑ 0.3% to $345,880

If you would like to read the complete report, it is available here, or please contact us if you have any questions relating to property investments, home loans and mortgages.