INFLATION INFLATION INFLATION!

Let’s start with a term that we hear every day, and in particular around the first Tuesday of each month when the Reserve Bank of Australia (‘RBA’) considers what will happen with interest rates.

Inflation is an increase (or decrease in the case of deflation) in the general level of prices of goods and services in the economy. A core function of the RBA is to ensure inflation remains consistent in Australia each year between 2-3%, which is modest and manageable at the business and household level and often in line with wages growth.

How does this work in practice?

To understand how this works, imagine a world that only has two commodities: Oranges picked from orange trees, and paper money printed by the government. In a year where there is a drought and oranges are scarce, we’d expect to see the price of oranges rise, as there will be quite a few dollars chasing very few oranges. Conversely, if there’s a record crop of oranges, we’d expect to see the price of oranges fall, as orange sellers will need to reduce their prices in order to clear their inventory.

These scenarios are inflation and deflation, respectively, though in the real world inflation and deflation are changes in the average price of all goods and services, not just one (i.e. food, petrol, electricity and so on).

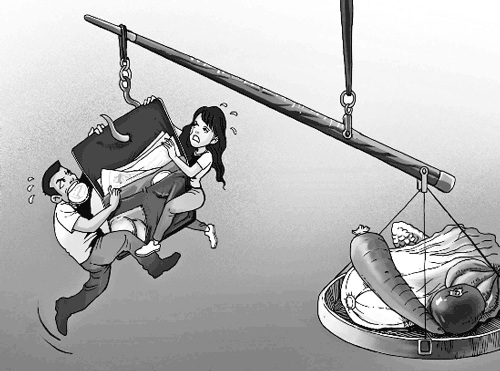

The key is ensuring your wage/income growth also keeps up – if the general cost of living increases by say 3% this year, but your wage remains the same, effectively your money will have less purchasing power than it did last year.

What does the RBA do?

If the RBA sees the inflation rate as too high (usually more than 3%), they will potentially raise interest rates. The desired impact is to curb our spending on goods and services. How? One of the common things most of us have are mortgages. A higher mortgage interest rate cuts into our disposable income.

“But what if I’m renting?”

Higher interest rates in general will see higher borrowing costs for property investors which generally speaking will drive up rents. Either way, it has the effect of reduced consumer spending. Lower spending by consumers and therefore businesses means less demand for goods and services, which reduces or slows price increases.

“So what do I do?”

- Commence and update regularly a personal budget to see where prices are changing, and look manage these if possible. I.e. reduce spending, change spending habits, look for a better deal.

- Regularly check your mortgage rate, and any other loans (investment or personal) you may have to make sure they are the best deal you can get.

- Re-consider your investment choices to ensure they are keeping ahead of inflation – including cash, your superannuation and property. Your investments need to be actively managed and performing well. Do not simply “set and forget”. These need to reviewed each year and can be affected by your income, taxation and yes – inflation. For example: holding cash in a bank account earning 3% p.a. is not actually growing if inflation is also 3%.

- Think outside the box: “bricks and mortar plus cold hard cash”. We’ve all heard the saying, however this does often not by itself, lead to a comfortable lifestyle for the average wage earner. Explore other options and talk to a specialist.

What can Aspect Wealth Advisers offer to assist you?

No matter your what your current financial situation is, we are all impacted by inflation. We assist many retirees, families, singles or couples including small business owners with the following:

- Budgeting and cash-flow management for those growing their wealth, or wanting to get on top of their finances.

- Advising on the most appropriate investments considering your goals, time-frame and long-term inflationary impacts.

- Investment structures, property and tax for people growing their wealth or for those approaching / in retirement looking to ensure their accumulated wealth provides the income they need.