Are you the trustee of a self-managed super fund (SMSF)?

Have you been thinking about setting up a SMSF?

Do you want to invest in a property inside super?

Do you have a long-term investment timeframe?

Let’s look at the broad outline of how this can be achieved.

How does it work?

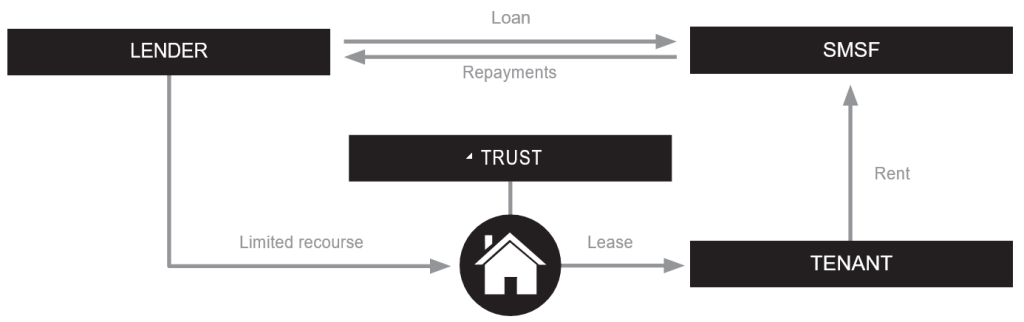

Changes to superannuation legislation allow self-managed super funds (SMSFs) to borrow to invest, providing certain conditions are met. If you have an SMSF, you may be able to use these arrangements to help buy a residential investment property through your fund.

Say, for example, your SMSF wants to buy a residential investment property but doesn’t have enough funds for a full purchase. It does, however, have enough funds to make a partial payment. The SMSF can purchase the property under a Limited Recourse Borrowing Arrangement (LRBA) (i.e. in the event of default, the lender only has recourse to the property and cannot claim any other SMSF assets).

In this scenario:

- The SMSF makes a partial payment on the property, and borrows funds to pay the balance plus other acquisition costs – using the property as security under a ‘limited recourse’

- The property is held in a trust for the SMSF, which is entitled to the rental income

- The SMSF pays off the loan over the agreed period

- After the loan is repaid, legal ownership of the property can be transferred to the SMSF

What does it mean for me?

This strategy allows your SMSF to acquire property that’s worth more than what is available in the fund, by repaying multiple installments over the long term.

This arrangement offers some advantages:

- Your SMSF receives all income and capital growth from the property, even if the property has not been paid

- Your SMSF can use income from the property and future contributions to help pay off the

- Interest expenses may be claimed as a tax deduction by the SMSF and potentially reduce your SMSF’s tax

- Because the property is purchased using a limited recourse loan, the lender only has recourse over the property itself – meaning the other assets in the SMSF are secure in the event of default.

- Income after expenses and any capital gain on disposal may be taxed at lower rates (i.e. 0%-15%) in the hands of the SMSF

Things you should consider

There are a number of complex rules and regulations around buying property inside an SMSF, so it’s important to seek professional financial, legal and tax advice specific to

your circumstances.

Some of the key things you should consider include:

- Your SMSF trust deed must allow

- A legal professional should establish the trust structure to ensure it meets certain

- Investment in a residential property must be consistent with your SMSF’s investment strategy and in the best interest of its

- Your SMSF must have the ability to pay instalments over the term of the

- You must purchase the residential property from an unrelated Arrangements must be at arm’s-length and transacted at market rates.

- Life insurance for members must be considered and noted, so that in the event of permanent disability or death, the member or their beneficiaries can be paid without the need to sell the residential

Strategy in action

Suppose your SMSF has $150,000 in the cash account. As the SMSF trustee, you want to buy a residential investment property worth $275,000.

If you buy the property on behalf of your SMSF under a LRBA, the $150,000 can be used to make an initial payment for the property. The shortfall of $125,000, plus $25,000 in stamp duty and acquisition costs, is funded by a limited recourse loan – using the property itself as security.

You then arrange for the property to be leased to an unrelated party at market rates. The rent, together with other SMSF income and/or member contributions, is used to make interest and loan repayments. Once the loan is paid off, legal ownership of the property can be transferred to the SMSF.

This strategy may not suit everyone, and can be heavily dependant on the value of your superannuation fund. One benefit of a SMSF is allowing spouses to combine their superannuation. We specialise in this area of advice therefore please do not hesitate to contact us and discuss further on +61 7 3354 9000 or enquiry@aspectwealthadvisers.com.au

Interested in a SMSF? Click here for more information

Question? You can also submit one below: